Abiraterone is an essential medication in the treatment of prostate cancer, with global procurement expected to rise significantly in 2024. Governments and healthcare agencies prioritize its availability due to its effectiveness in managing metastatic castration-resistant prostate cancer (mCRPC). This report examines the uses of Abiraterone, total government spending, leading purchasing countries, key regions, major buyers, and significant funding agencies.

Uses of Abiraterone

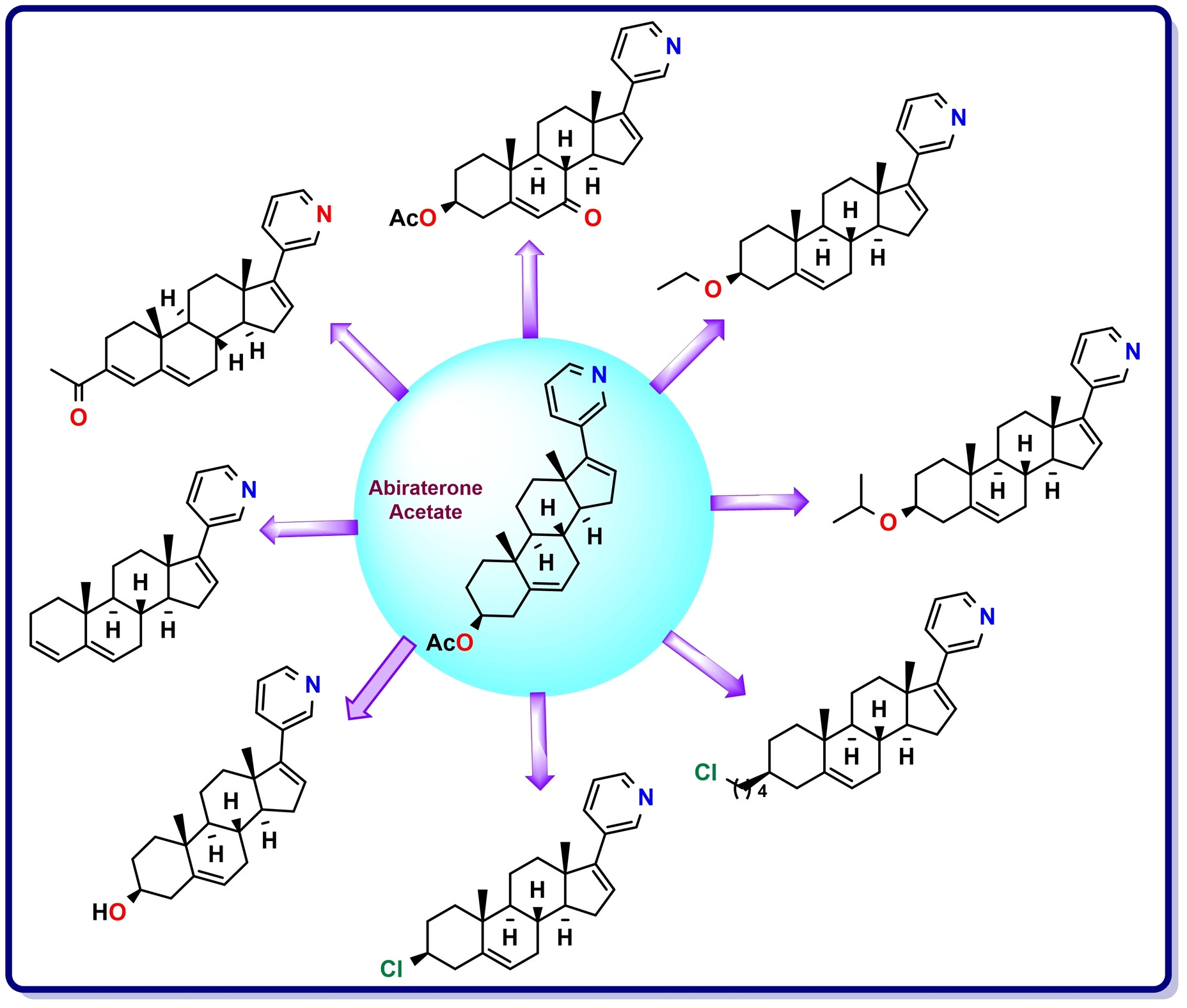

Abiraterone is an androgen biosynthesis inhibitor primarily used to treat metastatic castration-resistant prostate cancer. By inhibiting the CYP17 enzyme, it reduces androgen production, slowing cancer progression. Typically administered alongside prednisone, it improves patient outcomes. Due to its proven efficacy, it remains a cornerstone in prostate cancer management.

Total Government Spending on Abiraterone in 2024

In 2024, the global market for Abiraterone continued its upward trajectory. Valued at approximately $2.6 billion in 2023, it is projected to grow at a CAGR of 7.9%, reaching $5.1 billion by 2032. With rising awareness, advancements in targeted therapies, and improved access to treatment, demand for Abiraterone is increasing worldwide. Although specific government spending figures are not publicly available, this growth reflects a strong commitment to enhancing prostate cancer care and improving patient outcomes.

Top Country Buyers

- United States: Medicare and federal health programs invested over $1.2 billion in Abiraterone, ensuring access to prostate cancer treatment and reinforcing the nation’s commitment to oncology care.

- China: Government spending on Abiraterone increased by 18%, expanding access to advanced cancer therapies and improving public health outcomes.

- India: Public healthcare initiatives prioritized affordable cancer treatments, with Abiraterone purchases rising by 25% to meet growing demand.

- Germany, France, and the United Kingdom: These countries maintained high procurement levels, collectively spending over €600 million to ensure widespread availability of Abiraterone through their national healthcare systems.

Top Regions for Procurement

- North America: Accounting for $101.4 billion in 2024, nearly 46% of the global oncology drug market. Advanced research, high healthcare spending, and comprehensive insurance coverage drive cancer treatment accessibility.

- Europe: With an estimated market value of $60 billion in 2024, government-funded healthcare systems and centralized purchasing processes ensure widespread access to innovative cancer therapies.

- Asia-Pacific: Projected to reach $45 billion in 2024, driven by rising healthcare investments, a growing population, and increasing awareness of early cancer detection.

- Latin America & Africa: Expected to surpass $14 billion in 2024, supported by international partnerships, regional cancer programs, and expanding healthcare initiatives.

Top Buyers and Procuring Authorities

- U.S. Department of Health & Human Services (HHS): Manages a $2.37 trillion budget in 2025, representing 21.9% of federal spending. The Centers for Medicare & Medicaid Services (CMS) handles major medicine purchases, processing over one billion Medicare claims annually.

- European Medicines Agency (EMA): Oversees centralized pharmaceutical procurement in the EU. In 2024, it approved 114 medicines, including 46 with new active substances.

- World Health Organization (WHO): Promotes global healthcare access, particularly in lower-income nations. Through COVAX, it has distributed 1.8 billion COVID-19 vaccine doses across 144 countries.

- National Health Ministries: Regulate medicine procurement and safety. The UK’s Medicines and Healthcare products Regulatory Agency (MHRA) ensures the safety and efficacy of medicines, with similar agencies operating worldwide.

Top Funding Agencies

- Global Fund: Invests $5B+ annually in health, with $4.3B from private partners in 2024, expanding access to Abiraterone.

- World Bank: Disbursed $10.1B in 2024 to strengthen healthcare and improve access to Abiraterone.

- Gates Foundation: Contributed $3.62B to the Global Fund, pledging $927M (2023-2025) to enhance Abiraterone availability.

- UNDP: Supports medicine procurement and healthcare sustainability, increasing Abiraterone access in developing nations.

- Gavi: Allocated $500M in 2024 to improve healthcare, facilitating better access to cancer treatments like Abiraterone.

Conclusion

The procurement trends for Abiraterone in 2024 highlight its critical role in prostate cancer treatment. Governments and funding agencies are allocating substantial resources to ensure accessibility. With global investment in oncology drugs on the rise, sustained efforts in procurement will be key to addressing the growing demand for effective cancer treatments.

#Abiraterone #ProstateCancer #OncologyDrugs #PharmaProcurement #CancerTreatment #GlobalHealthcare #Globaltenders #DrugFunding #MedicalAccess #HealthcareInvestment #CancerResearch #Pharmaceuticals #WHO #HHS #EMA #HealthcareInnovation