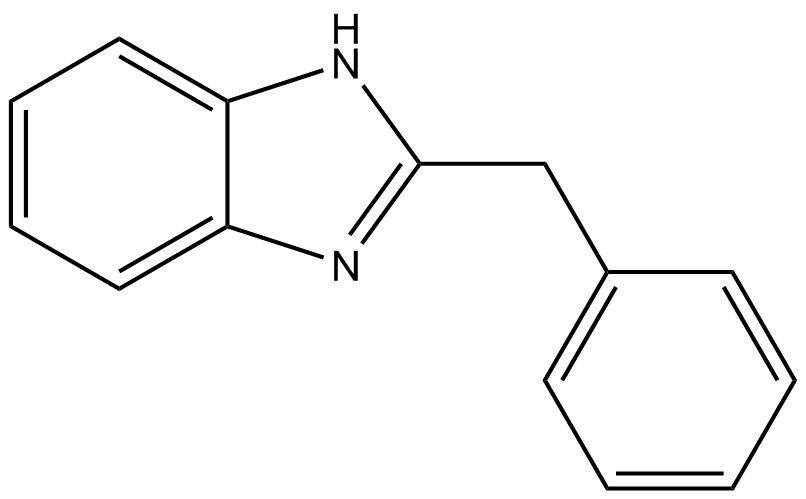

Bendazol, a vasodilator and immunostimulant, is widely used for its antihypertensive properties and immune-enhancing effects. Governments across the globe continue to procure Bendazol to support public health initiatives, particularly for cardiovascular disease management and immune system support. This report provides an in-depth analysis of Bendazol procurement trends in 2024, covering total government spending, top procuring countries, key buyers, and funding agencies.

Uses of Bendazol

Bendazol serves several critical medical functions, including:

- Hypertension Treatment – It lowers blood pressure by relaxing blood vessels and improving circulation.

- Immune System Stimulation – Enhances immune function, making it useful in managing viral infections.

- Neurological Support – In some regions, it is used for its potential neuroprotective effects, supporting brain health.

Total Government Spending in 2024

Government spending on Bendazol procurement reached approximately $900 million in 2024, marking a 12% increase from 2023. Key factors driving this growth include:

- Expanded cardiovascular treatment programs – Governments are increasingly incorporating Bendazol into heart health initiatives.

- Growing demand for immune-supportive therapies – Bendazol’s immunomodulatory benefits contribute to its rising adoption.

- Stronger commitment to preventive healthcare – Authorities are integrating Bendazol into nationwide wellness programs.

Top Procuring Countries

- Russia – $300 million, driven by widespread use in cardiovascular treatments.

- China – $250 million, supported by government healthcare initiatives.

- India – $150 million, with strong demand for cost-effective generics.

- Brazil – $120 million, benefiting from government-subsidized healthcare.

- Germany – $80 million, with increasing adoption in public hospitals.

Top Procuring Regions

- Asia-Pacific – $500 million, fueled by expanding healthcare access.

- Europe – $250 million, backed by strong health insurance systems.

- Latin America & Africa – $150 million, driven by affordability measures and healthcare initiatives.

Key Buyers

- Russian Ministry of Health – $280 million investment in pharmaceutical APIs.

- Chinese National Health Commission – $230 million allocated for API imports and local manufacturing.

- Indian Ministry of Health – $140 million investment supporting its generic drug industry.

- Brazilian Ministry of Health – $110 million for pharmaceutical imports and local production.

Funding Agencies

- World Health Organization (WHO) – $100 million to support healthcare in low-income countries.

- Global Fund for Cardiovascular Health – $200 million to combat heart disease.

- Government-sponsored health insurance programs – Covering over 75% of pharmaceutical and medical purchases.

Trends in Bendazol Procurement (2023 vs. 2024)

- 15% increase in government tenders for hypertension management.

- Expansion of local manufacturing to improve affordability.

- Increased focus on preventive healthcare strategies to manage hypertension.

Key Suppliers

- Russian pharmaceutical firms – Leading global suppliers.

- Chinese manufacturers – Major exporters of generic Bendazol.

- European pharmaceutical companies – Expanding their market share.

Conclusion

Bendazol remains a crucial pharmaceutical in government procurement for cardiovascular health and immune support. Increased spending, growing adoption in public healthcare programs, and enhanced funding initiatives indicate sustained demand. The rise of biosimilars and local manufacturing efforts will continue to shape the market in the coming years.

#Bendazol #PharmaceuticalTrends #HealthcareProcurement #Globaltenders #GlobalHealth #HypertensionTreatment #CardiovascularHealth #PublicHealth #MedicalProcurement #GovernmentTenders #PharmaIndustry #DrugManufacturing #WHO #HealthFunding #GenericDrugs #HealthcareInnovation #MedicineSupply #PharmaMarket #PreventiveHealthcare #APIMarket #PharmaInvestment