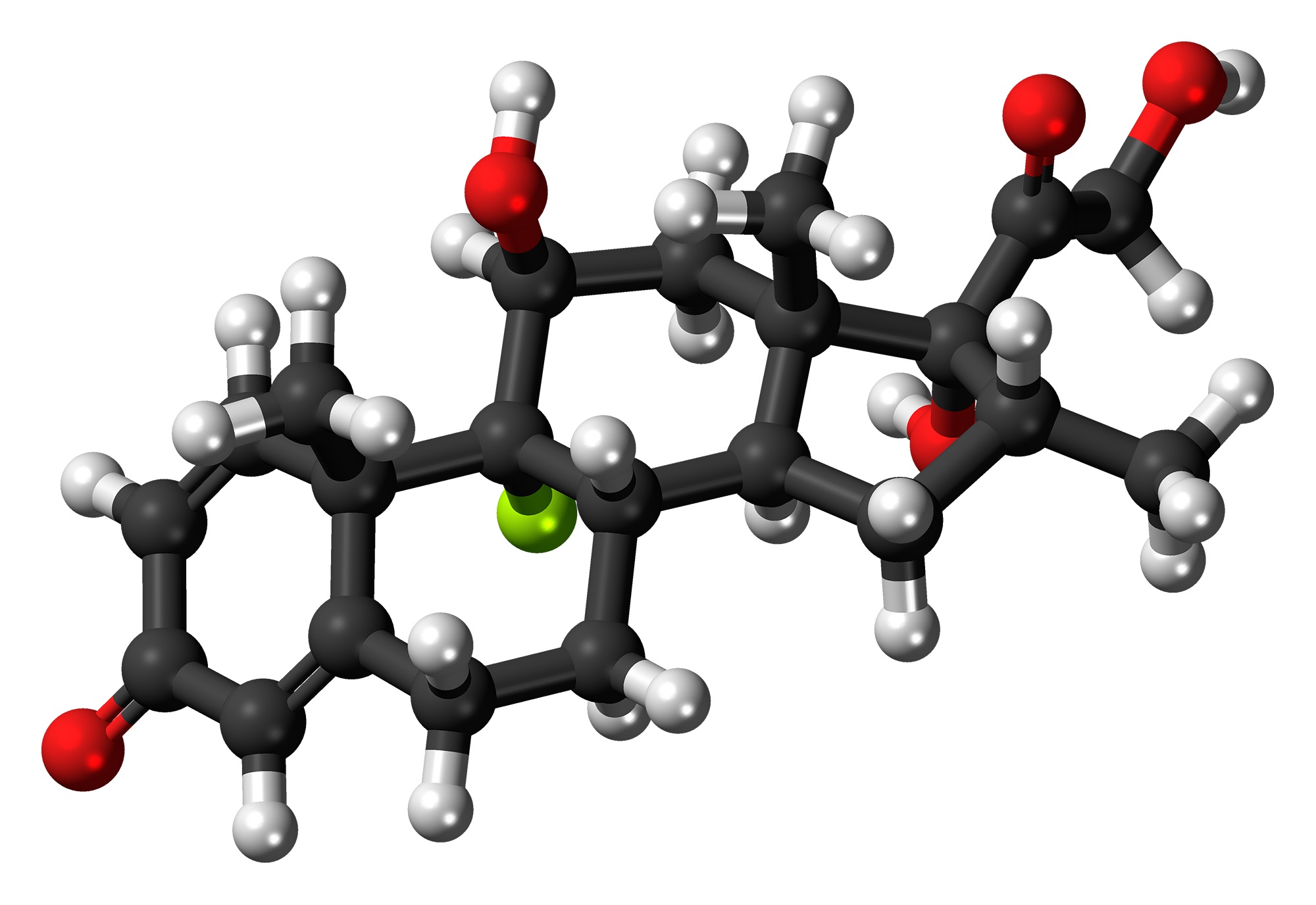

Dexamethasone, a potent corticosteroid used to treat inflammatory conditions, autoimmune diseases, and severe respiratory illnesses, continues to be a crucial pharmaceutical in government procurement. Its role in managing COVID-19 complications, asthma, arthritis, and cancer-related conditions ensures sustained demand in healthcare systems globally. This report provides an in-depth analysis of Dexamethasone procurement in 2024, covering total government spending, top procuring countries, key buyers, and funding agencies.

Uses of Dexamethasone

Dexamethasone is widely used for:

- Severe Inflammatory Conditions – Helps control inflammation in rheumatoid arthritis and lupus, alleviating symptoms.

- Respiratory Diseases – Reduces airway inflammation, aiding in asthma, COPD, and COVID-19-related complications.

- Cancer Treatment – Used in chemotherapy to manage inflammation, reduce side effects, and improve patient comfort.

- Neurological and Autoimmune Disorders – Helps manage multiple sclerosis by suppressing immune-related nerve damage.

- Post-Surgical Care – Minimizes swelling and prevents excessive immune reactions for smoother recovery.

Total Government Spending in 2024

Total government spending on Dexamethasone procurement reached approximately $2.5 billion in 2024, reflecting a 10% increase from 2023. The main factors behind this growth include:

- Ongoing demand for COVID-19 and respiratory illness treatments – Drives pharmaceutical innovation.

- Rising procurement efforts – Focus on enhancing cancer and autoimmune disease management.

- Greater access to affordable corticosteroids – Improves healthcare in developing nations.

Top Procuring Countries

- United States – $700 million, driven by Medicare and Medicaid programs.

- China – $500 million, due to its inclusion in national essential medicines.

- India – $400 million, supported by government-backed generic manufacturing.

- Brazil – $350 million, through expanding public healthcare investments.

- Germany – $250 million, driven by rising demand in public hospitals.

Top Procuring Regions

- North America – $1 billion in government pharmaceutical spending.

- Asia-Pacific – $800 million, driven by rising domestic production and demand.

- Europe – $500 million, relying heavily on government reimbursements.

- Latin America & Africa – $200 million, supported by international aid organizations.

Key Buyers

- U.S. Department of Health & Human Services (HHS) – Allocated $680 million for medical purchases.

- Chinese National Health Commission – Invested $480 million in healthcare-related procurements.

- Indian Ministry of Health – Committed $390 million for health sector purchases.

- Brazilian Ministry of Health – Spent $340 million on healthcare procurement.

- European Medicines Agency (EMA) – Directed $250 million toward pharmaceutical investments.

Funding Agencies

- World Health Organization (WHO) – Allocated $300 million to support procurement in developing nations.

- Global Respiratory Health Initiative – Committed $200 million for global respiratory health efforts.

- Government-sponsored healthcare programs – Covering over 75% of global healthcare purchases.

Trends in Dexamethasone Procurement (2023 vs. 2024)

- 15% rise in respiratory-related tenders, particularly for COVID-19 and flu treatments.

- Expanded drug usage in oncology and neurological care.

- Reinforced generic drug policies to lower costs.

- Increased domestic pharmaceutical production in Asia and Latin America.

Key Suppliers

- Pfizer – Leading global supplier with a broad portfolio across multiple therapeutic areas.

- Novartis – Strong market presence in corticosteroids with a focus on innovative treatments.

- Sun Pharmaceutical – Major supplier of generics, offering affordable medications worldwide.

- Mylan & Teva Pharmaceuticals – Focused on expanding affordability and enhancing global access to essential drugs.

- Chinese State-Owned Pharmaceutical Firms – Driving increased domestic production to meet local and international demand.

Conclusion

Dexamethasone remains a key pharmaceutical in global government procurement, particularly for respiratory, inflammatory, and cancer-related conditions. The rise in generic manufacturing and expanded healthcare access initiatives indicate continued market growth. Future procurement trends will likely be shaped by new clinical applications and cost-reduction strategies.

#DexamethasoneProcurement #HealthcareSpending2024 #GlobalPharmaceuticals #Globaltenders #Corticosteroids #RespiratoryDiseases #CancerTreatment #AutoimmuneDisorders #COVID19Treatment #PublicHealthProcurement #GovernmentSpending #PharmaceuticalTrends #GenericDrugs #GlobalHealthInitiatives #HealthcareAccess #PharmaInnovation #DrugProcurement #DexamethasoneTrends #TopPharmaceuticalBuyers #GlobalHealthExpenditures #HealthSectorInvestments #MedicalProcurement