Antigens are essential for diagnostics, vaccine development, and immunological research. In 2024, global demand for antigens has risen significantly, fueled by advancements in infectious disease management and vaccine innovation. This report explores key procurement trends, including total government spending, leading purchasing countries, major regions, top buyers, and funding agencies driving antigen acquisition.

Uses of Antigens

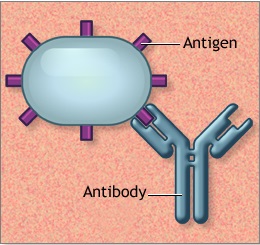

Antigens play a pivotal role across various sectors of healthcare and biotechnology, driving advancements in diagnostics, therapeutics, and research.

- Precision Diagnostics: Enable rapid and accurate detection of infectious diseases like COVID-19, influenza, and tuberculosis.

- Innovative Vaccine Development: Trigger strong immune responses, driving next-generation vaccine advancements.

- Breakthrough Therapeutics: Engineered antigens are transforming immunotherapies and precision medicine for cancer and autoimmune diseases.

- Advanced R&D: Support cutting-edge studies on immunity, disease pathology, and novel treatments.

Total Government Procurement in 2024

- Antigen Testing Investments: The global COVID-19 antigen test market, valued at $11.01 billion in 2023, is expected to decline, but governments continue funding testing infrastructure.

- Public Health Budgets: The U.S. HHS has a 2024 budget of $144.3 billion (discretionary) and $1.7 trillion (mandatory), supporting antigen procurement and disease surveillance.

- Vaccine Market Trends: The WHO is tracking vaccine procurement shifts, reflecting changes in supply and post-pandemic demand.

- COVID-19 Vaccine Updates: Experts recommend using monovalent JN.1 variants in future vaccines for better protection.

- Pandemic Preparedness: Governments are stockpiling H5N1 vaccines—5 million doses in the UK and 4.8 million in the U.S.

Top Country Buyers

Governments around the world are focusing on public health and innovation, increasing their demand for antigens. Here are the key countries leading the way:

- United States: A leader in disease surveillance and vaccine research, ensuring robust public health preparedness.

- China: Rapid growth in the biopharmaceutical sector is fueling strong investments in antigen acquisition for medical advancements.

- India: Expanding immunization and diagnostic programs backed by government initiatives are driving increased antigen demand.

- Germany, France, and the United Kingdom: With well-established healthcare systems, these nations maintain consistent procurement to support cutting-edge medical research and diagnostics.

Top Regions for Procurement of Antigen

- North America: Leading the antigen market at $5.2B in 2024, driven by $1.8B in government funding, strong disease surveillance, and biotech-public health collaborations. The U.S. and Canada dominate with advanced R&D and supply chains.

- Europe: Expected to surpass $4.7B, driven by major investments in immunology and vaccine R&D. Germany, France, and the UK lead with over $2B in spending, supported by strict regulations and recombinant antigen innovations.

- Asia-Pacific: Growing at 10% CAGR, reaching $3.9B in 2024, fueled by biotech advances, vaccine production, and $1.5B in government funding. China, India, and South Korea drive growth.

- Latin America & Africa: Market to reach $1.5B, backed by WHO and Gavi’s $800M funding. Brazil and South Africa expand local manufacturing to improve vaccine accessibility.

Top Buyers and Procuring Authorities

- WHO: Sets global standards for antigen diagnostics and vaccines, facilitating access through partnerships. In 2024, it recommended updating COVID-19 vaccines to target JN.1 and supported procurement for 100+ low- and middle-income countries.

- CDC: Enhances public health research and labs, providing guidance and funding. In 2024, it expanded global efforts, supporting 60+ research projects and strengthening lab networks for rapid disease response.

- EMA: Regulates vaccines and antigen diagnostics in the EU, offering scientific recommendations. In April 2024, it advised updating COVID-19 vaccines to JN.1, impacting 440+ million people.

- National Health Ministries: Manage antigen procurement based on local needs. In 2024, the European Commission coordinated 215,000 vaccine doses for Africa CDC to combat Mpox, demonstrating global collaboration.

Top Funding Agencies

- Global Fund to Fight AIDS, Tuberculosis, and Malaria: With over $55 billion invested since its inception, the Global Fund actively supports antigen-based diagnostic programs to combat infectious diseases.

- World Bank: Committed to global health, the World Bank has allocated $14 billion for disease surveillance and immunization initiatives, strengthening healthcare systems worldwide.

- Bill & Melinda Gates Foundation: A leader in medical innovation, this foundation has dedicated over $30 billion to vaccine development and antigen research, accelerating breakthroughs in global health.

- United Nations Development Programme (UNDP): Focused on essential health solutions, UNDP provides critical funding to ensure equitable access to antigens, particularly in low-income regions.

Conclusion

Antigen procurement in 2024 reflects a growing commitment to public health preparedness. Governments and funding agencies are prioritizing investments in diagnostic testing, vaccine development, and immunological research. Sustained procurement strategies will be essential to addressing emerging infectious diseases and advancing global health initiatives.

#AntigenProcurement #GlobalHealth #Globaltenders #VaccineDevelopment #InfectiousDiseases #PublicHealth #Biotechnology #MedicalResearch #HealthcareFunding #Immunology #DiseaseSurveillance