The economy of Bangladesh is a major developing market economy. As the second largest economy in South Asia, Bangladesh's economy is the 35th largest in the world in nominal terms, and 25th largest by purchasing power parity. Bangladesh is seen by various financial institutions as one of the Next Eleven. It has been transitioning from being a frontier market into an emerging market. Bangladesh is a member of the South Asian Free Trade Area and the World Trade Organization. In fiscal year 2021 2022, Bangladesh registered a GDP growth rate of 7.2% after the global pandemic. Bangladesh is one of the fastest growing economies in the world.<br>Industrialization in Bangladesh received a strong impetus after the partition of India due to labor reforms and new industries. Between 1947 and 1971, East Bengal generated between 70% and 50% of Pakistan's exports. Modern Bangladesh embarked on economic reforms in the late 1970s which promoted free markets and foreign direct investment.

Top Sectors in Bangladesh

Agriculture in Bangladesh

Agriculture is the largest employment sector in Bangladesh, making up 14.2 percent of Bangladesh's GDP in 2017 and employing about 42.7 percent of the workforce. The performance of this sector has an overwhelming impact on major macroeconomic objectives like employment generation, poverty alleviation, human resources development, food security, and other economic and social forces. A plurality of Bangladeshis earn their living from agriculture. Due to a number of factors, Bangladesh's labor-intensive agriculture has achieved steady increases in food grain production despite the often unfavorable weather conditions. These include better flood control and irrigation, a generally more efficient use of fertilizers, as well as the establishment of better distribution and rural credit networks.

Banking and Finance in Bangladesh

Most banks in Bangladesh are privately owned. Until the 1980s, the financial sector of Bangladesh was dominated by state-owned banks. With the grand-scale reform made in finance, private commercial banks were established through privatization. The next finance sector reform programme was launched from 2000 to 2006 with a focus on the development of financial institutions and adoption of risk-based regulations and supervision by Bangladesh Bank. As of date, the banking sector consisted of 4 SCBs, 4 government-owned specialized banks dealing in development financing, 39 private commercial banks, and 9 foreign commercial banks.

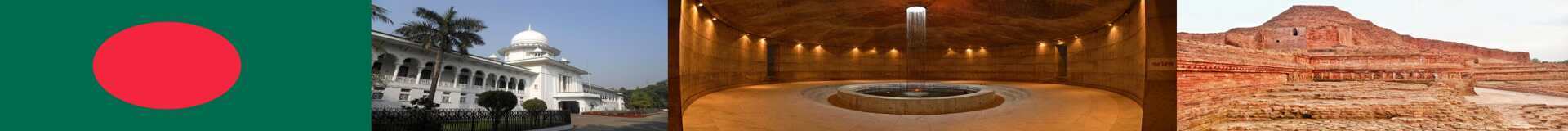

Tourism in Bangladesh

The World Travel and Tourism Council (WTTC) reported in 2013 that the travel and tourism industry in Bangladesh directly generated 1,281,500 jobs in 2012 or 1.8 percent of the country's total employment, which ranked Bangladesh 157 out of 178 countries worldwide. Direct and indirect employment in the industry totaled 2,714,500 jobs, or 3.7 percent of the country's total employment. The WTTC predicted that by 2023, travel and tourism will directly generate 1,785,000 jobs and support an overall total of 3,891,000 jobs, or 4.2 percent of the country's total employment. This would represent an annual growth rate in direct jobs of 2.9 percent. Domestic spending generated 97.7 percent of direct travel and tourism gross domestic product (GDP) in 2012. Bangladesh's world ranking in 2012 for travel and tourism's direct contribution to GDP, as a percentage of GDP, was 142 out of 176.

Information and Communication Technology in Bangladesh

Bangladesh's information technology sector has seen significant growth in the past three years. Bangladesh has 80 million internet users, with an estimated 9% growth in internet use by June 2017, powered by mobile internet. Currently, Bangladesh has an active 23 million Facebook users and 143.1 million mobile phone customers. The country exported $800 million worth of software, games, outsourcing, and services to European countries, the United States, Canada, Russia, and India by 30 June 2017.